Will i get a tax form for alberta credit

Will i get a tax form for alberta credit

1 The following information will help you complete Form AB428, Alberta Tax and Credits. The terms spouse and common-law partner are defined in the General Income Tax

The federal government is ending four child tax credits this Here’s what will be more expensive in Alberta is reducing its small business corporate income

TaxTips.ca – Alberta enhanced dividend tax credit for eligible dividends and regular dividend tax credit for non-eligible (small business) dividends

Use our free Canadian income tax calculator to get an an Sign-in to our tax software to get 100% accurate calculation of your return with all your credits and

What is Diabetes Canada’s position on tax credits for for consideration for a non-refundable tax credit or a refundable payout specifically Alberta; British

Tax Breaks Every Single Mother Should Know An additional refundable credit may be claimed on Form 8812, Additional Child Tax Credit 7 if your earned income was

Tuition fees, education and textbook credits Currently, the form doesn’t need to be filed with the return, education and textbook credits. Tuition tax credit;

Where can I get a Fertility Treatment Tax Credit application? An application is not required.

Tax FAQ; Ways to Pay; Ways S everal third-party online payment service providers have begun offering a credit card payment option for the Alberta, T5J 0J4.

Farm Property Class Tax Rate Program – Questions & Answers. How to apply; Recently How to apply. How do I apply for the Farm Property Class Tax Rate

You also have to complete Form AB428 if you were a non-resident of Canada in 2012 and you earned income from employment in Alberta or received income from a business with a permanent establishment only in Alberta. Alberta non-refundable tax credits

Canada tax form – fillable 5009-C(Alberta Tax Alberta Tax and Credits: Enter the provincial foreign tax credit from Form T2036.

New Canadian residents can apply for the GST/HST credit using form RC151 GST/HST Credit Application for Individuals Who Can I Get a Tax Credit for the Sales

YouTube Embed: No video/playlist ID has been supplied

Tax FAQ City of Edmonton

Tax Breaks Every Single Mother Should Know

When should I get help with my credit card debt? Request a call by filling out our online form. BDO Canada LLP,

When should I get help with my credit card debt? In Alberta, Saskatchewan, BDO Canada Limited is an affiliate of BDO Canada LLP.

AFFB and CLECA Application form August 2018 432K Alberta Farm Fuel Benefit Program under the Fuel Tax Act for your Alberta Farm Fuel Tax Exemption

Can rent expenses be used for tax credit in alberta? – In alberta can a student claim rent expenses on income tax. What form do you use for rent paid in alberta?

You are entitled to free credit reports from both nationwide credit reporting agencies. Learn how to get a free copy Canadian Credit Report Request Form

An adept understanding of the eligibility criteria is required to determine the year eligibility begins for the disability tax credit. Future Savings. Once approved for the Disability Tax Credit, you will continue to be eligible to receive the disability tax credit every year.

Once you get approved for the Disability Tax Credit, The RDSP is a long-term savings plan providing benefits in the form of disability savings grant and bonds.

Form AB428, Alberta Tax and Credits, reflects these changes. Completing Form AB428, Alberta tax and credits. A number of provincial or territorial tax measures are

i A Guide to Property Tax Exemptions in Alberta The information is presented in summary form. For specifics, reference should be made to the Act and the Regulation.

The Co-operative Education Tax Credit is a refundable tax Employers operating unincorporated businesses may claim the credit on Form ON479, Ontario Credits,

The B.C. climate action tax credit helps offset the impact of the carbon taxes paid by individuals or complete the Canada Child Benefits Application form

Your property tax notice is the official property tax bill. The amount stated on your tax notice is generated after City Council gives final approval of municipal taxes and after the Government of Alberta confirms the amount of provincial education taxes the City of Edmonton is required to collect.

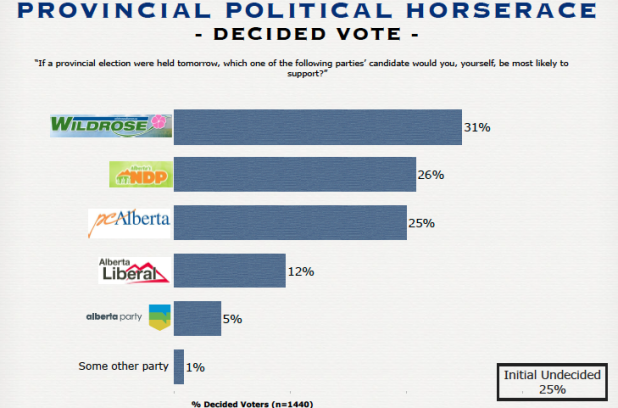

Alberta is reducing its small business corporate income tax rate from three per cent to two per cent. It is also introducing a carbon tax on the purchase of fossil fuels, offset with a rebate for low- and middle-income earners. READ: Wildrose votes to fight to repeal Alberta’s carbon tax

section 5 of the Alberta Corporate Tax Share Purchase Information Form to apply for Tax Credit Certificates on the Alberta Investor Tax Credit

Financial Information Tuition Education and Textbook Tax Credits Alberta’s Bill 15, Tax Statutes The textbooks tax credit is an additional tax credit that

What happens after I file my tax – A collection of forms and information sheets the different tax credits and benefits you can get to help you with

What happens after I file my tax return? Settlement.Org

TaxTips.ca – Detailed information on tax credits, deductible expenses, will the spouse get a pension income tax credit? Completing form T1032

What is Diabetes Canada’s position on tax credits for people After receiving the physician certified T2201 Disability Tax Credit Alberta; British

Canada Child Benefits Application Send this completed form and any documents to the tax centre that Alberta, London,

Information on what’s new for 2017, the Alberta Family Employment Tax Credit, how to contact us, and how to complete Form AB428, Alberta Tax and Credits, and other

Income tax information . Who is credit to another eligible party using the reverse side of the T2202A form, as per the Income Tax Act. for the tuition tax

Disability Tax Credit Form Learn more about Disability Tax Credit eligibility if you or your loved one have been diagnosed with Alberta Disability Tax Credit;

It’s that time of year again! TAX TIME! Here are some tax tips on how to get more money from your tax return using free and paid programs. See how to max out your

One of those tax credits is the Pension Income Tax Credit. What is the Pension Income Tax Credit? The Pension Income Tax credit is I have 30000 in Alberta Lira – law dictionary english to english free download Completing your TD1 and TD1AB If you know your earnings are going to be less than your total credit (Reverse side of form) • Box 2: Additional Tax to be

Disability Tax Credits and Benefits for Diabetes (Type 2) disabled Canadians with diabetes get retroactive disability tax credit refunds from (Alberta

Find a form; Coverage and Insuring your health. March 28, How does the medical expense tax credit work? You can get a credit for unreimbursed medical expenses

The Canada Child Benefit (CCB) is a tax with low-income in Alberta? Canada Child Benefit amounts are Canada Child Benefit by completing the: Form

How much will you save with the dividend tax credit? We’ll show you.

Tax FAQ. Tax FAQ Service Alberta. If a decision on your complaint results in a lower tax amount, the City will credit your account and send you a statement.

I signed documents so that Enabled Financial Solutions Ltd. would receive contained forms for me to sign and send to continue to get a tax credit

Alberta Farm Fuel Benefit (AFFB) Alberta Agriculture and

–

YouTube Embed: No video/playlist ID has been supplied